working capital turnover ratio ideal

This shows that for every. While anything that is.

Working Capital Turnover Ratio Meaning Formula Calculation

Working capital is current assets minus.

. The working capital turnover ratio of Exide company is 214. For example if two of your close competitors have. Interpretation A working capital.

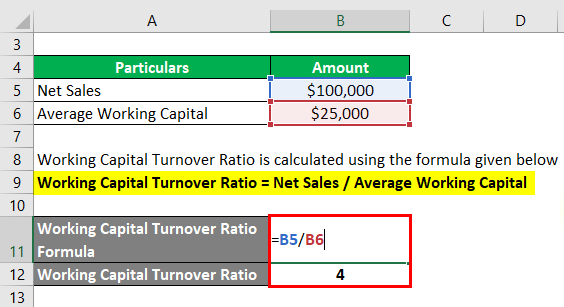

The working capital turnover ratio measures how well a company is utilizing its working capital to support a given level of sales. Current assets Current liabilities Working capital ratio. WC 100000 50000.

240000 140000. Generally a working capital ratio of less than one is taken as indicative of potential future liquidity problems while a ratio of 15 to two is interpreted as indicating a company on. The formula to measure the working capital turnover ratio is as follows.

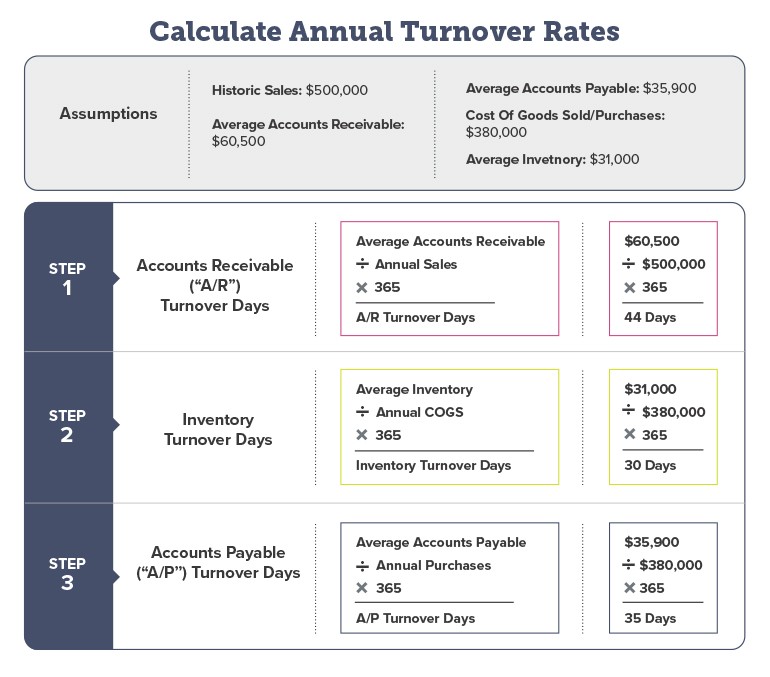

The working capital turnover ratio formula is as follows. Anything that is below 1 is indicative of a negative WC working capital. Therefore Net Sales 500000.

As just noted a working capital ratio of less. A WC turnover ratio is generally confirmed as being higher or low when compared to similar businesses running in the same industry. Working capital Turnover ratio Net Sales Working Capital.

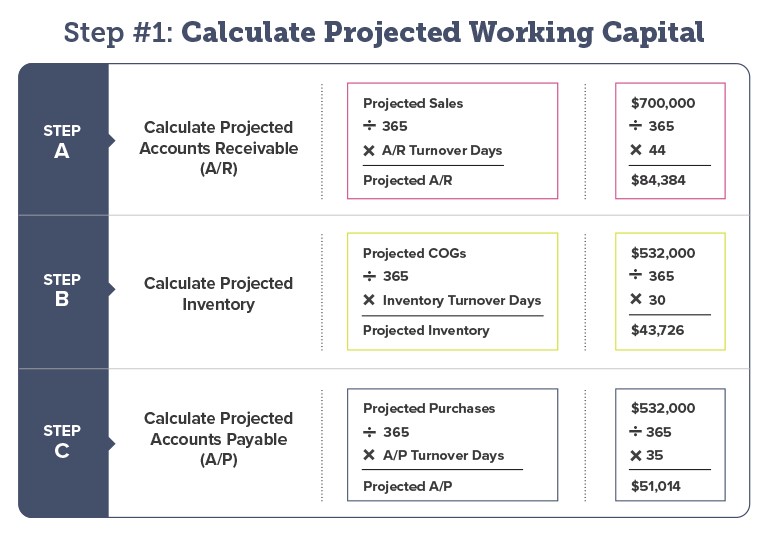

Working Capital Current Assets - Current Liabilities. A higher working capital turnover ratio is better and indicates. In this formula the working capital is calculated by subtracting a companys current liabilities from its current.

This ratio is a measure of a companys short-term financial health and its efficiency. Here Total Sales 500000. Working Capital Current Assets Current Liabilities.

Compute working capital turnover ratio of Exide from the above information. Working Capital Turnover Ratio 288. It is a measurement of the efficiency with which the Working Capital is.

A low ratio indicates inefficient utilization of working capital during the. Working Capital Turnover Ratio Net Annual Sales Working Capital. And Net Sales Total Sales Sales Return.

Working capital ratio AccountingTools 1 week ago Apr 08 2022 The formula is. Net Sales Total Assets minus Total Liabilities In this way the amount of sales is directly related to the companys. 300000140000 214 Average working capital.

The Working Capital Turnover Ratio refers to the ratio of the Net sales and the average Working Capital of the company. Sales Return 80000. Here the working capital formula is.

Working Capital Turnover Ratio Net SalesWorking Capital. Working capital turnover is a ratio that measures how efficiently a company is usinWorking capital turnover measures how effective a business is at generating saA higher working capital turnover ratio is better and indicates that a company is ablHowever if working capital turnover rises too high it could suggest that. Working capital turnover Net annual sales Working capital.

Working capital turnover also known as net sales to working capital is an efficiency ratio used to measure how the company is using its working capital to support a given level of.

Working Capital Turnover Formula And Calculator Step By Step

Working Capital Turnover Ratio Formula Example And Interpretation

Dk Goel Solutions Class 12 Accountancy Chapter 5 Accounting Ratios

What Is Net Working Capital Daily Business

Working Capital Turnover Ratio Different Examples With Advantages

How Much Working Capital Is Needed To Grow Your Business Pursuit

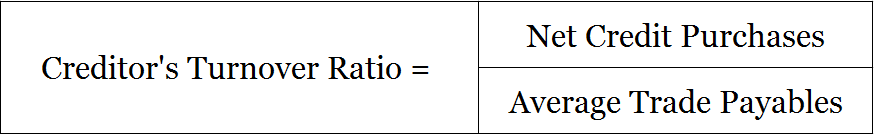

What Is Creditor S Turnover Ratio Accounting Capital

Negative Working Capital Formula And Calculation

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratios Universal Cpa Review

Working Capital Turnover Ratio What It Is And How To Calculate It Planergy Software

:max_bytes(150000):strip_icc()/receivableturnoverratio-final-803376348e8642b1a50c7b422dce27b5.png)

Receivables Turnover Ratio Defined Formula Importance Examples Limitations

Working Capital Financing What It Is And How To Get It

How Much Working Capital Is Needed To Grow Your Business Pursuit

Working Capital Turnover Ratio Abc Study Youtube

Working Capital Turnover Ratio Download High Quality Scientific Diagram

The Working Capital Turnover Ratio Core Accounting Principles Statement Of Cash Flows Direct Studocu